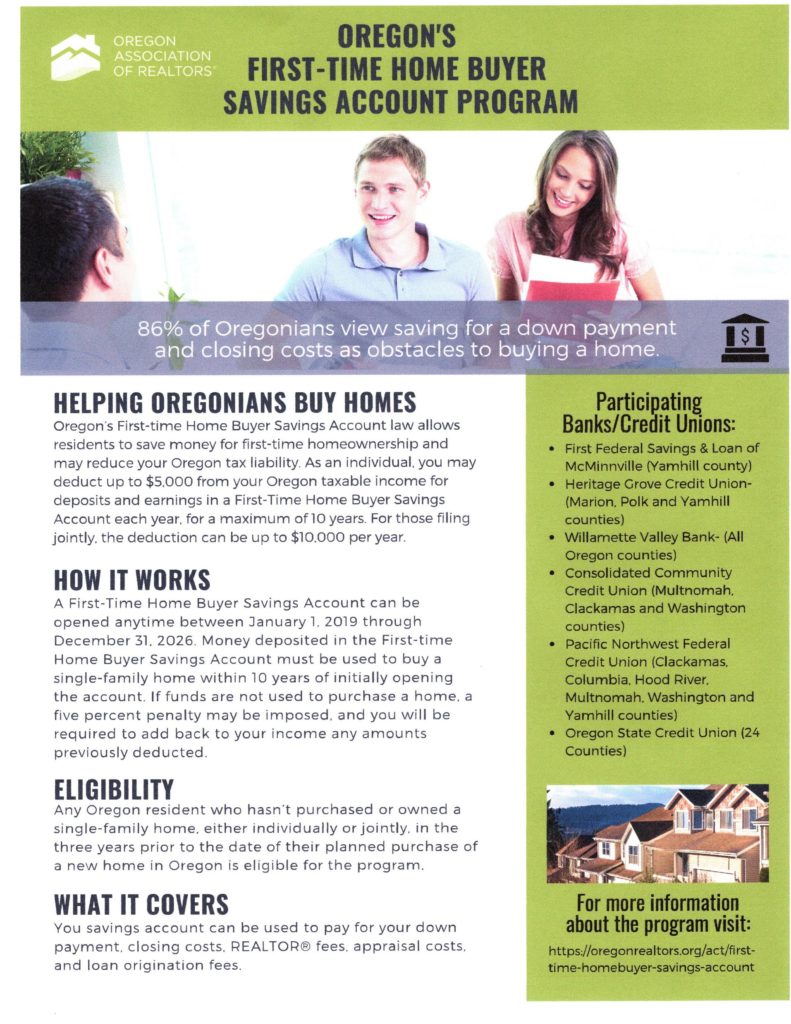

Open Online in Minutes. A First-Time Homebuyer Savings Account is a special account created by the Oregon legislature in 2018 for resident taxpayers intending to buy their first Oregon home.

Oregon S First Time Home Buyer Savings Account Fthbsa Solid State Tax Service

As an individual you may deduct up to 5000 from your Oregon taxable income for deposits and earnings in a First-Time Home Buyer Savings Account each year for a maximum of 10 years.

. January 1 2019 is the first day to open a First-Time Homebuyer Savings Account in Oregon. First Time Homebuyer Savings Account Earn 2 00 Apy On Deposits Up To 20 000 Cccu Oregon S First Time Home Buyer Savings Account Fthbsa Solid State Tax Service. A FTHBSA can be opened any time between January 1 2019 and December 31 2026.

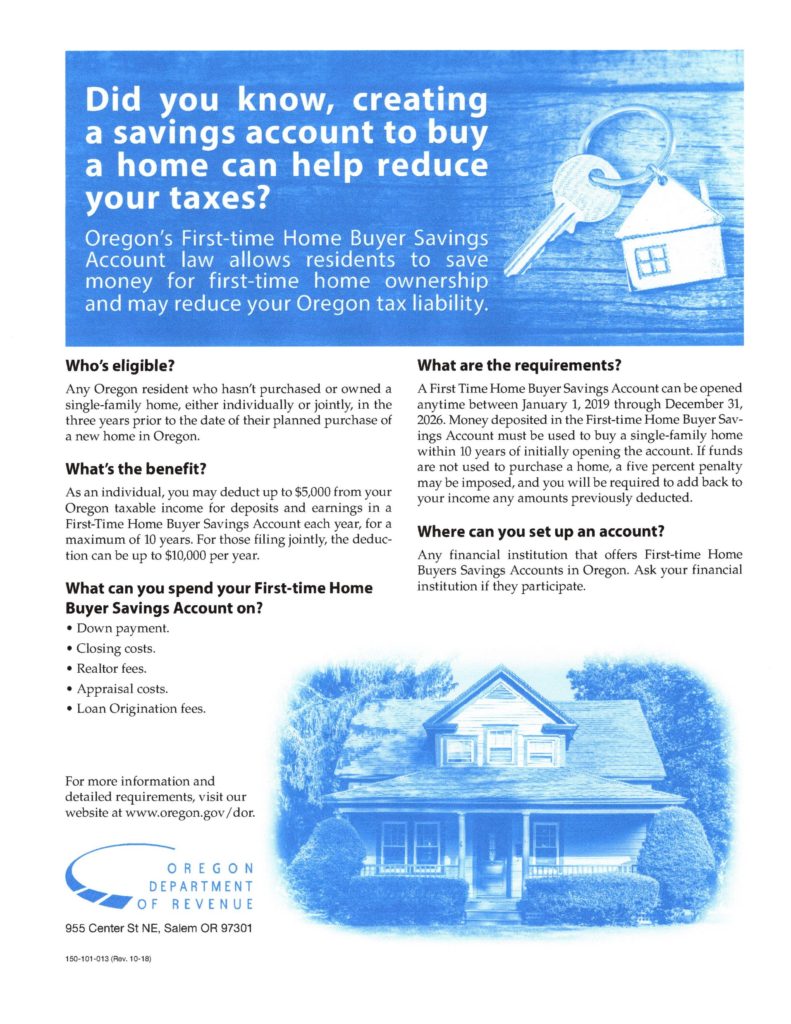

Furthermore you can find the Troubleshooting Login Issues section which can answer. Beginning January 1 2019 and ending December 31 2026 Oregon allows an income subtraction for first time home buyers with qualified savings accounts in the state. FIRST-TIME HOMEBUYER SAVINGS ACCOUNT GET THE FINANCIAL LEG UP YOU NEED EARN 150 APY ON DEPOSITS UP TO 20000 Depositors who are Oregon residents and have not owned a home in the last three years qualify to receive an Oregon state tax subtraction up to 5000 for a single filer and 10000 for joint filers per year.

Money deposited in the account must be used to pay qualifying costs of buying a single-family home within 10 years of initially opening the account. What costs will qualify. Beginning January 1 2019 and ending December 31 2026 Oregon allows an income subtraction for first time home buyers with qualified.

A first-time home buyer savings account is a tax-advantaged savings account that incentivizes home buyers to save toward their future home purchase. You must be a resident of Oregon purchasing a home in the state. For single filers up to 5000 in contributions and earnings can be deducted note that Oregon calls them subtractions instead of deductions from your Oregon taxable income for up to 10 years.

See disclosures rates and fees. This program allows qualified individuals to deduct up to 5000 single or up to 10000 married filing jointly from taxable income per year. Married filing jointly couples may be allowed to subtract up to 10000 from Oregon taxable income annually for a 10 year period of time with a maximum tax.

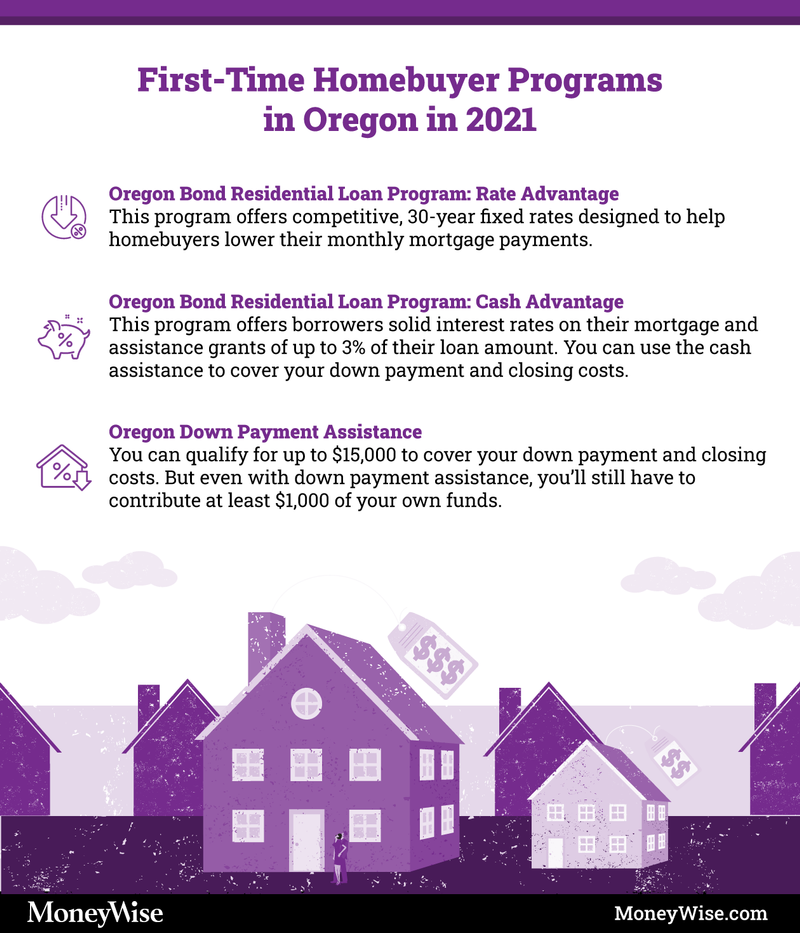

Down payment assistance grants of up to 15000. For those filing jointly the deduc- tion can be up to 10000 per year. What is a FTHSA.

This program allows qualified individuals to deduct up to 5000 single or up to 10000 married filing jointly from taxable income per year. Estate transfer taxes and fiduciary income taxes. Oregon First-Time Homebuyer Program FAQs Earn 100 APY on your savings You save money for your new home We pay you 100 APY on your savings Oregon gives you tax benefits on your savings open Now Account details Features Earn 100 APY on deposits No monthly fees Oregon tax advantages for qualified savers NCUA insured up to 250000.

What can you spend your First-time Home Buyer Savings Account on. To qualify you must be a first-time homebuyer or a buyer who hasnt owned a home in at least three years. January 1 2019 is the first day to open a First-Time Homebuyer Savings Account in Oregon.

To help make homeownership more affordable the First-time Homebuyer Savings account program allows Oregonians to take a state tax deduction on money saved towards the purchase of their first home. Ad Grow Your Savings with the Most Competitive Rate. 3 closing-cost assistance grant with a lower-rate mortgage.

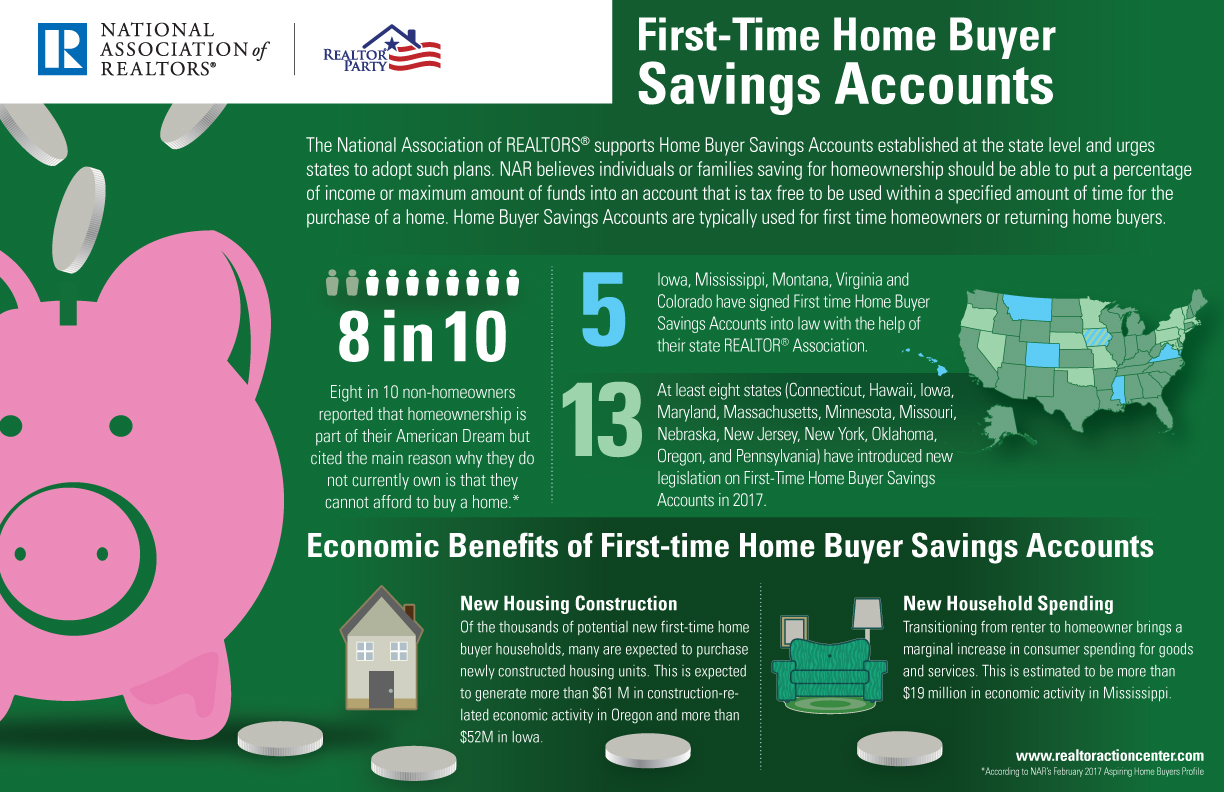

April 11 2019 Oregon Legislature took a significant step toward addressing the states affordable housing crisis by passing House Bill 4007 establishing a First-Time Home Buyer Savings Account program statewide. Federal adjustments to income. First-time Home Buyer Savings Accounts.

Locate a branch Open a First-time Homebuyer Savings account Features of the First-time Homebuyer Savings account. You may not subtract more than 50000 in all tax years. That was up 68 year over year.

Offers State of Oregon tax advantages for qualified savers. Community Connection of Northeast Oregon First-time homebuyers in Baker Grant Union or Wallowa counties who are also veterans could be eligible for a down payment assistance loan up to 15000. Filing options for individuals.

Eligibility Limits on borrower. Oregon first time home buyer savings account Written By tilmon11147 Sunday July 24 2022 Add Comment Edit. Beginning January 1 2019 Oregon became the 6th state in the nation to offer first-time home buyers a tax-free savings vehicle to help families purchase their own single-family residence.

Real Time Rate Comparison. Oregon First Time Home Buyer Savings Account will sometimes glitch and take you a long time to try different solutions. At that median prices your down payment.

Up to 5000 of deposits per year for individual or head of household filers or. Ad Own A 150000 Home With A 4500 Down Payment. Below-market interest rates for first-time borrowers.

Ad Get mortgage rates in minutes. Beginning January 1 2019 and ending December 31 2026 Oregon allows an income subtraction for first time home buyers with qualified savings accounts in the state. Subject to income limitations single filers can claim up to a 5000 Oregon income tax deduction.

To qualify you must be a first-time homebuyer or a buyer who hasnt owned a home in at least three years. You claim a state tax deduction for. Find Out How With Quicken Loans.

Canadians already have access to the Home Buyers Plan a program that allows first-time home buyers to unlock up to 35000 from their RRSP account tax-free and then pay back the withdrawn. The cash in your savings account can only be used for expenses related to buying your first home specifically your down payment and closing costs. Funds saved in these accounts can be applied on a tax-advantaged basis toward the down payment and closing costs of your first-home.

Make lenders compete and choose your preferred rate. LoginAsk is here to help you access Oregon First Time Home Buyer Savings Account quickly and handle each specific case you encounter. With these basic metrics in mind how do Oregon first-time home buyer savings accounts stack up.

Filing information and requirements for individuals. As an individual you may deduct up to 5000 from your Oregon taxable income for deposits and earnings in a First-Time Home Buyer Savings Account each year for a maximum of 10 years. You must be a resident of Oregon purchasing a home in the state.

Compare up to 5 free offers now. Down Payment Closing Costs Realtor Fees Appraisal Costs Loan Origination fees. For those filing jointly the deduction can be up to 10000 per year.

First-time Homebuyer Savings account features No monthly fees NCUA insured up to 250000 Offers State of Oregon tax advantages for qualified savers Offers an easy way to save for a first-time home purchase in Oregon Funds may be used for the following items. Gesundheit A FTHSA is a special account dedicated to saving funds for the purchase of a primary residence. Joint filers can claim up to a 10000 deduction.

You must use your FTHBSA funds to pay costs associated with buying a home such as. One of the most interesting. Compare Open an Account Online Today.

Oregon S First Time Home Buyer Savings Account Fthbsa Solid State Tax Service

First Time Homebuyer Savings Account Earn 2 00 Apy On Deposits Up To 20 000 Cccu

First Time Homebuyer Programs In Oregon 2022

First Time Homebuyers Savings Account Program Home Buying Savings Account Homeowner

Oregon S First Time Home Buyer Savings Account Fthbsa Solid State Tax Service

First Time Home Buyer Savings Accounts

First Time Home Buyer Jd Pdx Real Estate

Oregon First Time Home Buyer Program Guide 2022 Oregon Down Payment Assistance Grants First Time Buyer Loans Data Programs Tips Etc

0 comments

Post a Comment